The wine category has always been a jump ahead of most other beverage alcohol categories in terms of ecommerce. The pandemic heightened consumer needs for convenience and belonging, boosting wine ecommerce. How might this change going forward?

A strong tradition of buying wine online

A strong pre-internet tradition of distance selling, typically via mail order, gave wine businesses a strong foundation to pivot to a formal ecommerce model in the late 1990s.

“With the arrival of the internet as a legitimate sales channel in the late 1990s, many wine direct-to-consumer models, such as home delivery from local wineries or mail order wine specialists, moved to ecommerce as a sales and CRM method. Although in many cases these were also supplemented by phone and traditional direct mail, the idea of buying wine online is not new,” remarks Richard Halstead, COO, Wine Intelligence.

Until the 2010s, participation rates and volume market share of these types of direct-to-home ecommerce models were low, primarily because consumers used them for occasional purchases rather than habitual ones. In large part, this was due to structural issues with the business model – delivery charges made transactions more expensive and encouraged consumers to purchase wine by the case. Consumers inevitably linked these orders to an event or time of year where more wine would be consumed in a shorter space of time, such as over the holidays.

“In this model, the addressable market was limited by affluence of the consumer and by an occasion where a lot of wine was needed at one go, and people were at home to receive it. Longer delivery times and less flexibility around delivery days or time slots compounded the challenges,” notes Halstead.

A more flexible and personalised business model

What has boosted sales in recent years is the arrival of more flexible models of ordering and delivery, plus a change in the use case for wine ecommerce. In all cases, these seem to have been additive trends – the traditional distance selling models of the early internet era have carried on selling at similar levels, to a similar audience (who are now in their 50s and 60s) while the newer models broke fresh ground in terms of recruiting consumers and usage occasions.

Wine as part of a grocery purchase

In the past 10 years, online grocery delivery models have sprung up in most major markets, and in most of these markets, these businesses have been able to sell wine alongside groceries. The grocery model for wine ecommerce offered 3 key things that traditional wine ecommerce didn’t:

- Specified delivery slots: typically one-hour windows

- Faster delivery: within 2-3 days of ordering, sometimes sooner

- Flexible quantities (could order one or two products)

- One basket: remove the need for a separate transition with a specialist retailer

Wine delivery apps / part of foodservice apps

Immediate or near immediate delivery apps have been a huge growth engine in foodservice over the past 5 years, even before the pandemic. These solutions first rose to prominence in China, where various ecommerce platforms, such as JD.com, Tmall and TaoBao, pioneered fast delivery of alcohol products to consumers ordering via an app on their phone – often within an hour of ordering.

Today, delivery apps and ‘near-immediate’ delivery service is commonplace in major cities in many developed world countries, and in some developing world, such as Argentina, Brazil and parts of Southeast Asia.

Wine ecommerce as communities

Distance selling was changed by the arrival of the internet mainly in a functional way – the ordering process moved from post/phone to online. A big change of the past 10 years has been in the formation of wine ‘communities’, where entrepreneurs focused on providing forums for likeminded individuals to exchange information, such as with the Vivino app, or to support shared values, such as Naked Wines’ focus on supporting fair trading opportunities for smaller and more artisanal producers.

Impact of the pandemic

The arrival of Covid into major wine consumption markets turbocharged ecommerce wine business models across markets.

Traditional internet direct-to-home businesses – whose typical users are mainly over the age of 50 – saw a surge in orders from their traditional base who were most acutely concerned with the dangers of Covid, and more likely to be shielding at home. These businesses also saw a huge surge in orders from younger and middle-aged consumers, who quickly realised that one key advantage of being stuck at home was always being in for a delivery.

The post-2010 business models also saw a massive growth in customer traffic. The most established of these, the online grocery channel, was initially overwhelmed with customer demand and therefore constrained with what it could offer. The other two models, the ecommerce community and the delivery app, both benefited hugely from the surge in demand caused by various lockdowns.

“This was especially true among younger, urban, affluent consumers, who found themselves stuck at home more often, when they were used to a much more active social life,” reflects Halstead. “The opportunity to order in food and wine at the same time replicated, to a degree, the experience of going out and offered a convenient stay-at-home option,” he adds.

In comparison to 2019, Wine Intelligence data shows that all key markets have seen a growth in ecommerce and online purchasing, with 47% of regular UK wine drinkers, for example, purchasing wine online more frequently.

What will happen next?

The ecommerce models that have come to dominate the wine space are built around two fundamental principles: convenience and belonging.

“Pre-pandemic, convenience was a primary consumer driver of online wine shopping, though unless you had a grocery-style hourly delivery slot, waiting in for a delivery rather dampened that motivation,” notes Halstead.

Social belonging – that feeling of being part of a larger community of likeminded people – was already a growing force in wine ecommerce before the pandemic, and was also being adopted successfully by more traditional direct-to-home retailers. The pandemic heightened both consumer needs.

As the most acute restrictions of the pandemic begin to subside in some markets, the consumer need for convenience is perhaps the most vulnerable of the two.

A free-flowing urban population has a lot of opportunities to buy wine in person, and can do so on impulse. Planned purchases take time, thought and research – which, in a normal busy life, require special effort. A quick purchase via an app might feel convenient, and ordering in food with wine will likely still happen.

One of the best cards the wine category has to play is its ability to imbue the feeling of sophistication and enlightenment into the consumer experience. When other experiential pleasures are unavailable or banned, such as holidays or an evening out, the evidence suggests that people will default to a substitute that does a similar job and is available. Ecommerce businesses that tap into this feeling successfully will find a rich opportunity in the wine category for some time to come.

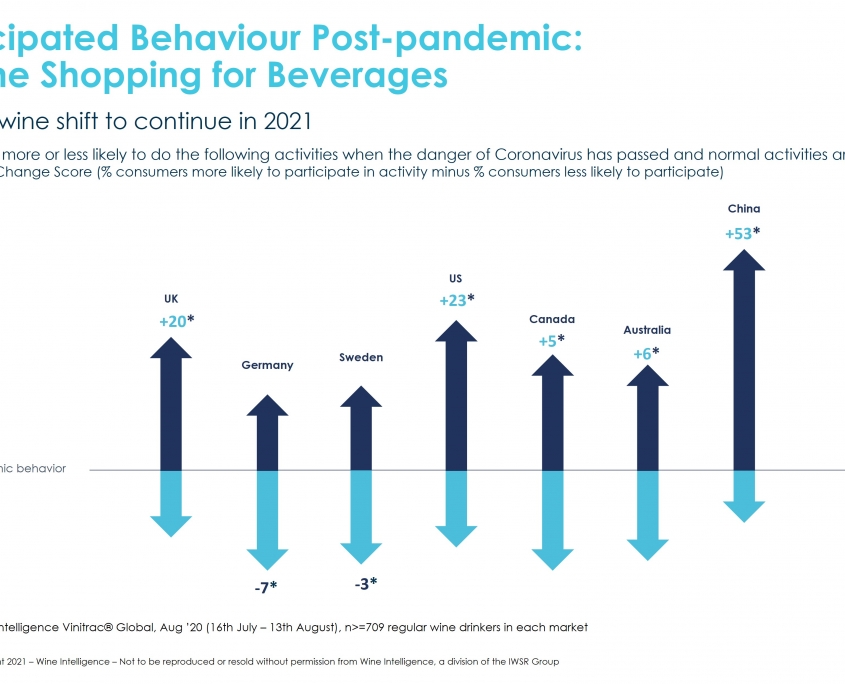

Indeed, Wine Intelligence consumer research clearly indicates that wine drinkers are committed to continue with online purchasing as restrictions get lifted across markets. In the UK, for example, a larger proportion of consumers have said they would be more likely to continue using online channels when purchasing beverages.

You may also be interested in reading:

Leave a Reply

Want to join the discussion?Feel free to contribute!