Consumer confidence with wine remains stable, yet consumers’ wine knowledge is steadily decreasing, new research by Wine Intelligence shows. However, these two trends are not as contradictory as they seemingly appear.

In terms of global wine consumer trends, there are two seemingly contrasting trajectories taking place.

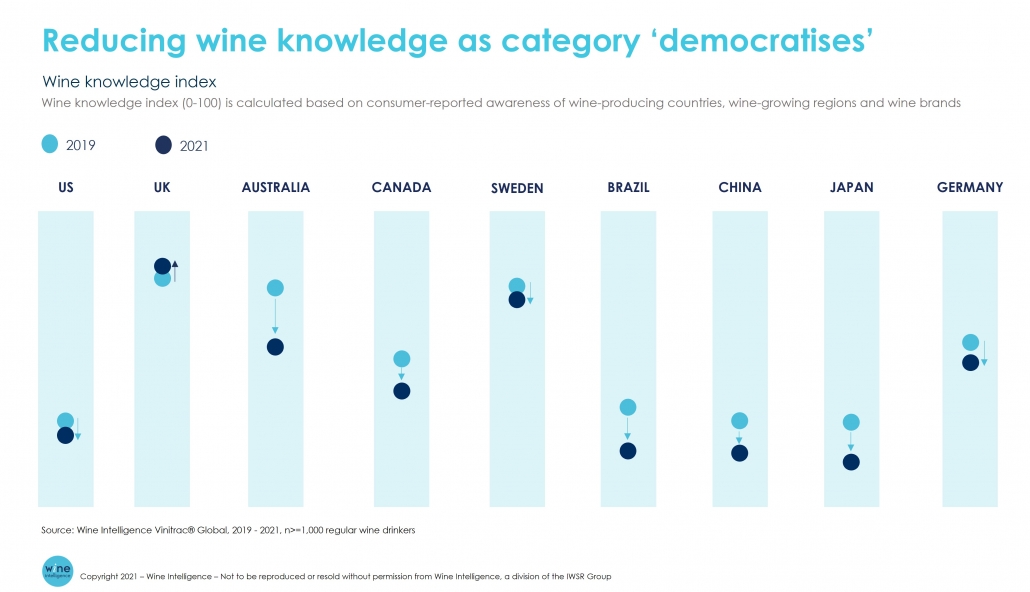

Research from Wine Intelligence shows that the breadth of wine knowledge amongst wine drinkers is gradually decreasing, as consumer knowledge of varietals, wine-producing origins and wine brands reduces. At the same time, consumer confidence in wine – which was historically correlated to knowledge – is stable and in fact, increasing marginally in some key markets.

This trend can be seen in markets such as the US, Brazil, Germany and Australia, where wine knowledge has decreased between 2019 and 2021. In the US, wine knowledge has taken the biggest downturn since 2017 as wine engaged ‘Generation Treaters’ drive category growth, but without the need to retain technical wine knowledge.

What has led to this broad global shift, and what is the implication for wine brands?

A significant contributing factor is ‘cognitive offloading’, which refers to consumers’ growing reliance on instant, online resources for information, rather than committing information to long-term memory. As such, while wine knowledge is being accessed, it is not necessarily being retained, leading to an overall reduction in retained consumer wine knowledge. The wealth of online sources of wine information, easily and rapidly accessible via a smart phone, are enabling buyers to purchase with confidence, without the need to retain hard facts.

“The wine industry has undoubtedly helped consumers to feel more confident both navigating and enjoying wine, without the need to bring with them and encyclopedic knowledge,” explains Lulie Halstead, CEO Wine Intelligence. “Wine consumers are being helped by the fact that many of today’s wine labels are both visually appealing and highly successful at explicitly communicating the flavours and tastes inherent to a particular brand,” she adds.

This response from the industry is making wine more inclusive as opposed to exclusive, as consumers no longer need to commit multiple facts to memory in order to participate. While confidence was historically linked to an individual’s breadth of knowledge, market changes are enabling wine to become more accessible and therefore ‘democratic’.

The dual trends of reducing wine knowledge and increasing wine confidence are therefore not as at odds with each other as they may first seem. “Confidence has become uncoupled with knowledge in recent years, creating a more inclusive wine category – a key necessity if it is to retain market share against challenges from craft beer and RTDs,” remarks Halstead. This is also supporting opportunities in channels such as convenience and online.

Going forward, how can brands adapt to the changing dynamics of the category to become more inclusive?

Clarity when it comes to communicating a wine’s flavour is important. There are successful shortcuts to achieve this, such as through label design, bottle shape, and broader brand communication. “Helping consumers understand flavour instinctively through visual branding cues is a good starting point,” says Halstead.

Since an increasing number of consumers want to quickly access information on the go, it will pay to have a good website that is easy to navigate and well optimised. While websites often dive deep into winemaking stories and the details of production, simple messaging and layered information will prove critical.

You may also be interested in reading:

Leave a Reply

Want to join the discussion?Feel free to contribute!